The new accounting standard applies to all banks, savings associations, credit unions, and financial institution holding companies (hereafter, institutions), regardless of size, that file regulatory reports for which the reporting requirements conform to U.S. Accordingly, responses to questions 4, 34, and 35 have been updated to reflect the new effective date for non-PBEs. 2018-19, Codification Improvements to Topic 326, Financial Instruments–Credit Losses, to mitigate transition complexity by amending the effective date of the new accounting standard for nonpublic business entities (non-PBEs) 3 to fiscal years beginning after December 15, 2021, including interim periods within those fiscal years. In November 2018, the FASB issued ASU No.

In addition, the Appendix includes links to relevant resources that are available to institutions to assist with the implementation of CECL. 2 The agencies have also made minor technical and editorial changes to previously published FAQs. Each question identifies the date the FAQ was originally published as well as the date(s) it was updated, if applicable. The focus of the FAQs is on the application of CECL and related supervisory expectations. The agencies have developed these frequently asked questions (FAQ) to assist institutions and examiners.

The Board of Governors of the Federal Reserve System (FRB), the Federal Deposit Insurance Corporation (FDIC), the National Credit Union Administration (NCUA), and the Office of the Comptroller of the Currency (OCC) (hereafter, the agencies) issued a Joint Statement on June 17, 2016, summarizing key elements of the new accounting standard and providing initial supervisory views with respect to measurement methods, use of vendors, portfolio segmentation, data needs, qualitative adjustments, and allowance processes. 1 The new accounting standard introduces the current expected credit losses methodology (CECL) for estimating allowances for credit losses. 2016-13, Topic 326, Financial Instruments – Credit Losses, on June 16, 2016.

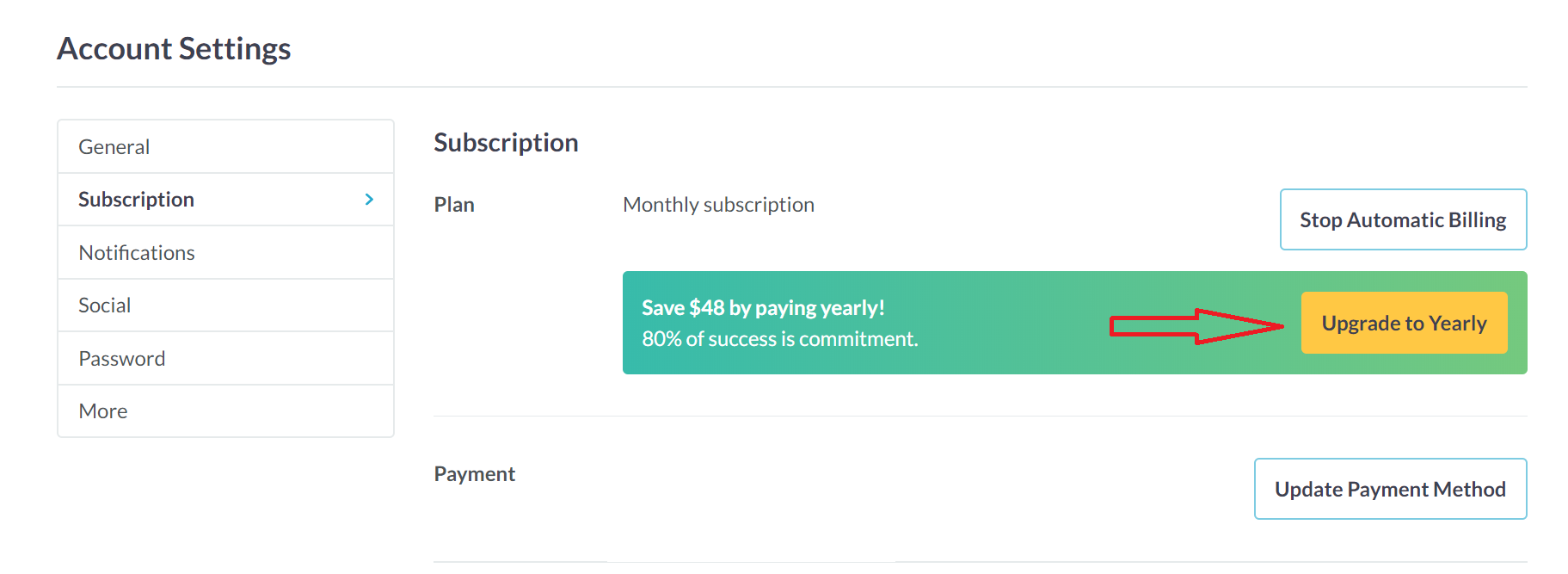

PREMIUM ACCOUNTS VS STANDARD ACCOUNTS STATISTICS UPDATE

The Financial Accounting Standards Board (FASB) issued a new accounting standard, Accounting Standards Update (ASU) No.

Regulation II (Debit Card Interchange Fees and Routing).Regulation CC (Availability of Funds and Collection of.Securities Underwriting & Dealing Subsidiaries.Enforcement Actions & Legal Developments.

Federal Financial Institutions Examination Council (FFIEC)īanking Applications & Legal Developments.Federal Reserve Supervision and Regulation Report.Community & Regional Financial Institutions.

0 kommentar(er)

0 kommentar(er)